The simpler, smarter way to 529

Open a top-tier 529 plan in minutes and let family & friends give toward your child’s future.

Already have an account? Log in

Start saving in a top-tier 529 within 5 minutes

Manage unlimited accounts, starting at $0 per month

Everyone who cares about your child can contribute

The smart way to save for education

You want the best future for your child, but there’s so much to figure out along the way. We’ve taken the guesswork out of saving for education, so you can take at least one thing off your list.

The right 529 plan for you

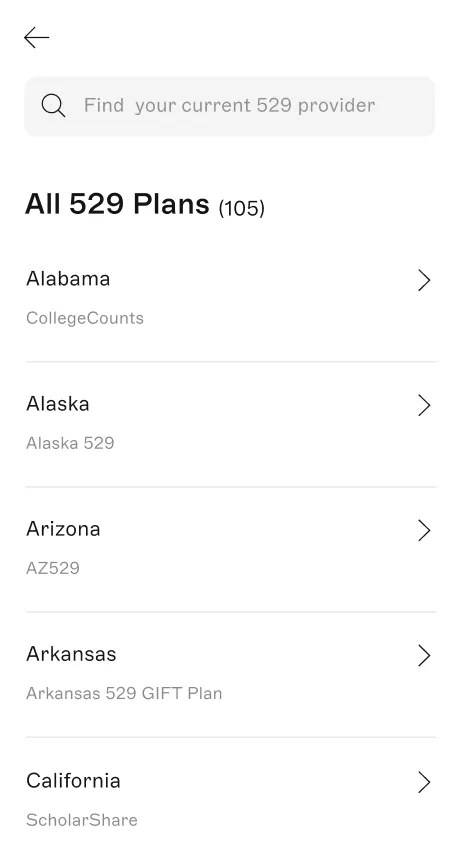

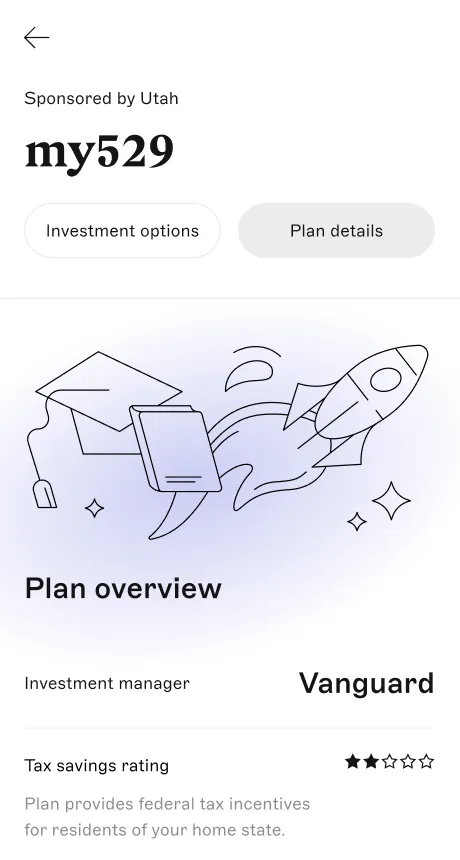

529s are confusing, with over 100 different ones in the U.S. We’ve done the hard work of evaluating all of them so we can recommend the right one for your family in just a few minutes.

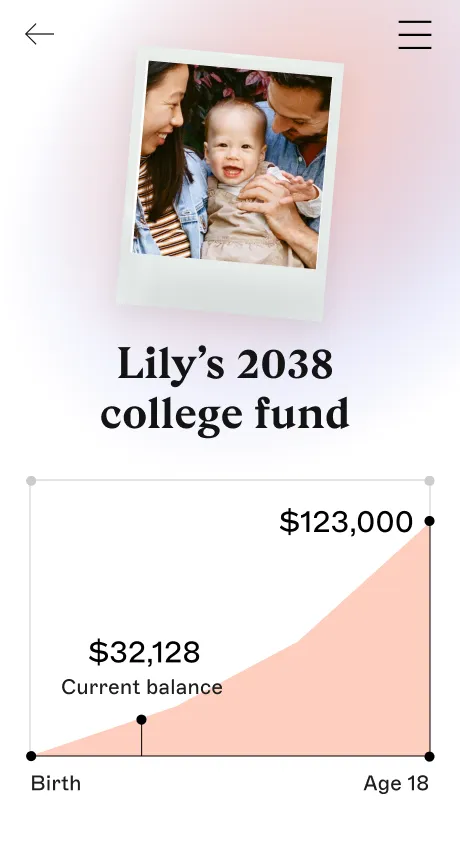

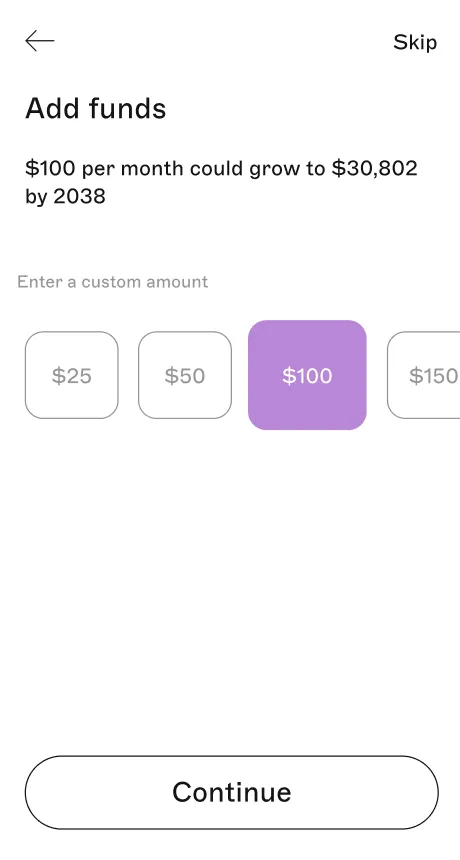

Super simple saving

Paperless setup. Automated contributions. Real-time projected savings. It's everything you need to manage your fund, all from your phone.

Gifts that make a difference

Every fund has a custom link that’s easy to share, so family and friends can contribute. Think birthdays, holidays... Wednesdays.

Save money for college tax-free

It's like a 401K for education, so you can grow your savings tax-free. If you've been wondering how you'll be able to save enough for college, a 529 plan is your answer.

Learn more about 529s

Backer works with most 529 plans

Already have a 529? Connect it to Backer to use our mobile app and invite family & friends to give.

Your child’s backers

Add to the fund with one-time and recurring gifts

Gramps

Sophie

Uncle Robbie

Mateo

Aunt Lucy

Big love from Backer families

Surprise: it's not just parents who love saving together.

We really needed to start saving for our baby. I love that family members can make contributions. Instead of giving the baby gifts or monetary gifts they can just make a contribution towards their college fund. It makes me feel comfortable knowing we are saving for his future.

@andrea_mrllo

We really needed to start saving for our baby. I love that family members can make contributions. Instead of giving the baby gifts or monetary gifts they can just make a contribution towards their college fund. It makes me feel comfortable knowing we are saving for his future.

@andrea_mrllo

“I love using Backer to help my sister save for her daughter's college education.”

Instead of gifting my niece another toy that she's ultimately going to get bored of at some point, I prefer helping to save for her future. I will definitely open my own Backer account when I have a kid someday. Highly recommend!

It is hard to save but I believe in asking for help, so I asked friends and family to help and we are doing it as a team. Let’s give our kids the freedom to decide what they wanna do.

@thecarlinfamily

250K+

People saving with Backer

$70M+

Money saved for college

$500M+

Future debt avoided

It's like an insurance policy for your child's future

Your Backer 529 savings can be used to cover all kinds of education expenses, not just college tuition. Think books and supplies, housing, K12 tuition, bootcamps, apprenticeships, and more.

Advice you can trust

As an SEC-registered investment adviser, we have a fiduciary duty to put your interests before ours.

Serious about security

Your personal information is protected with bank-level encryption and secure servers monitored 24/7/365.

Low, transparent fees

Instead of a percentage share of your savings, we charge a low monthly fee or $1.99 per contribution.

Give Backer a try

What would you name your family fund? Check out some of our recent Backer fund names our recent Backer fund names for inspiration.